rantizo in the news

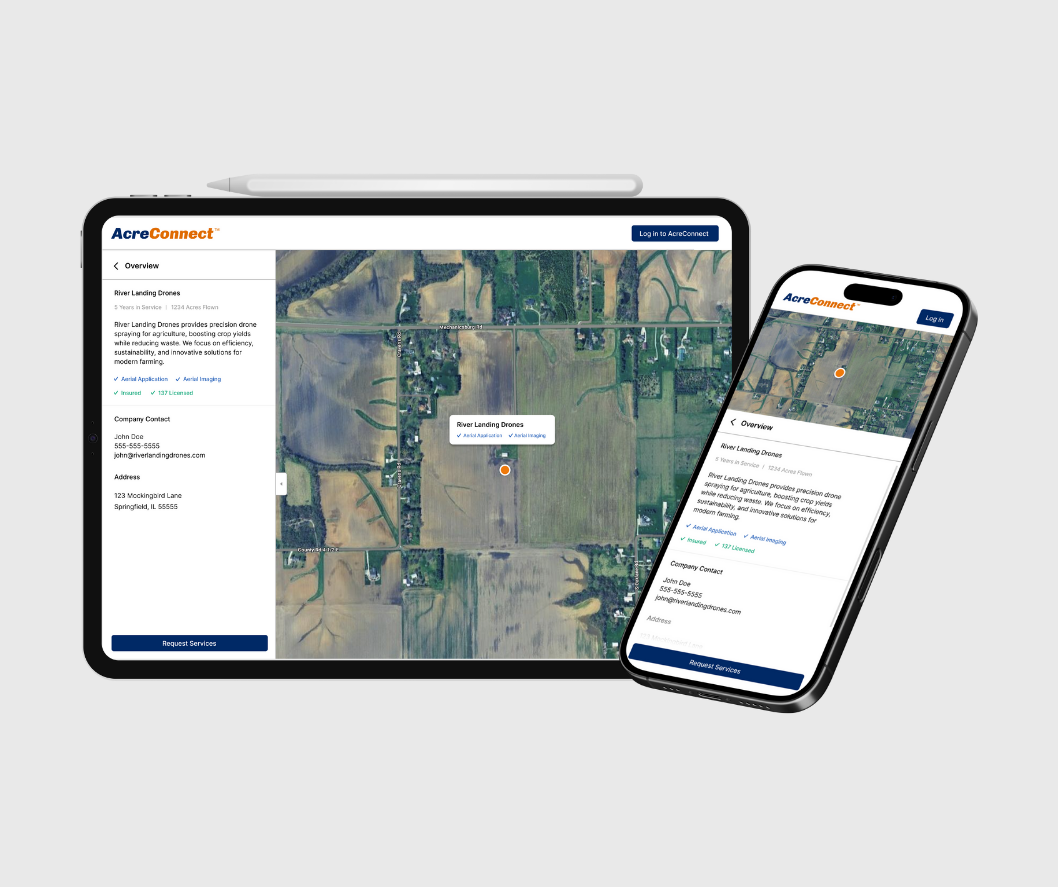

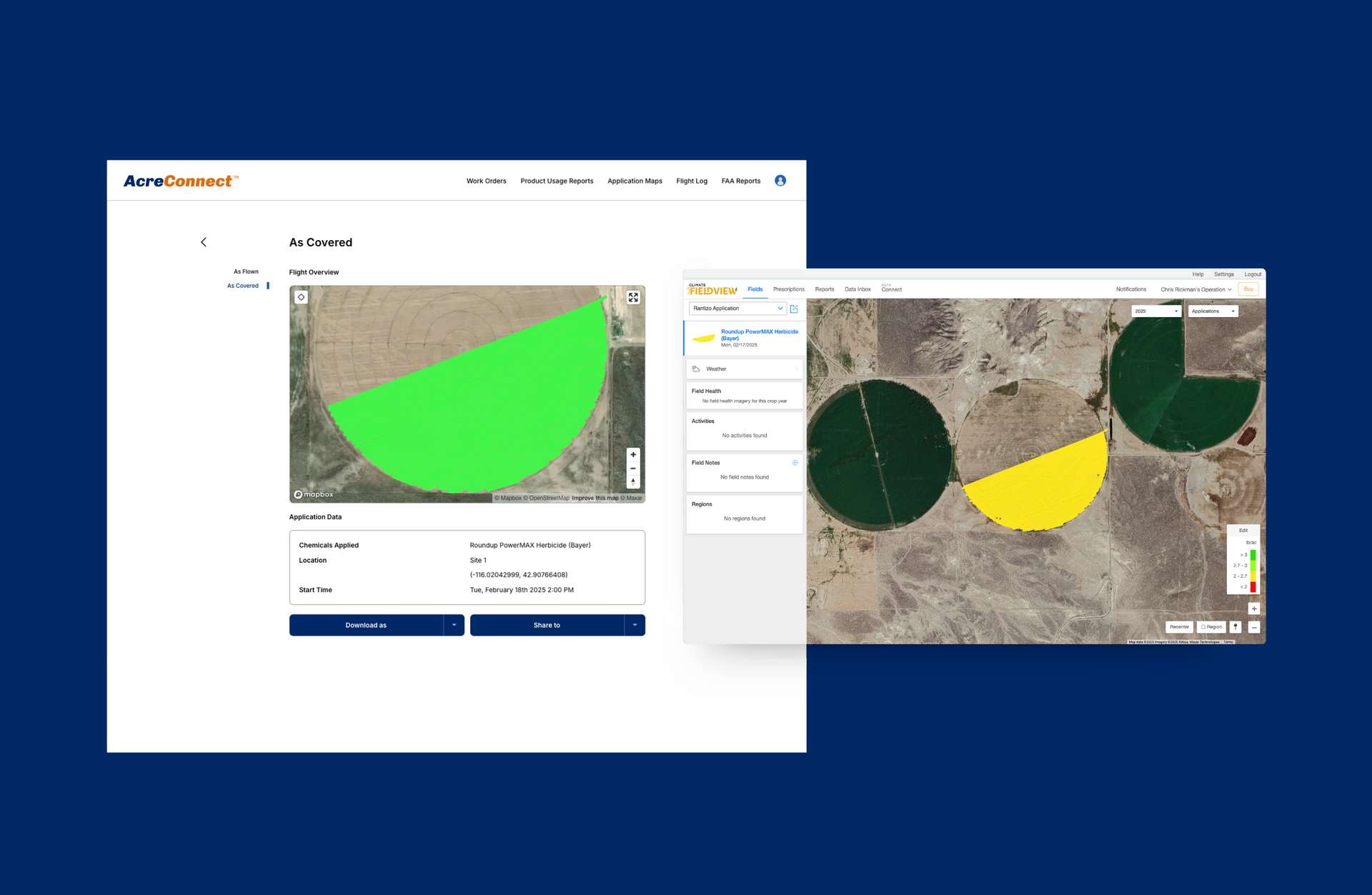

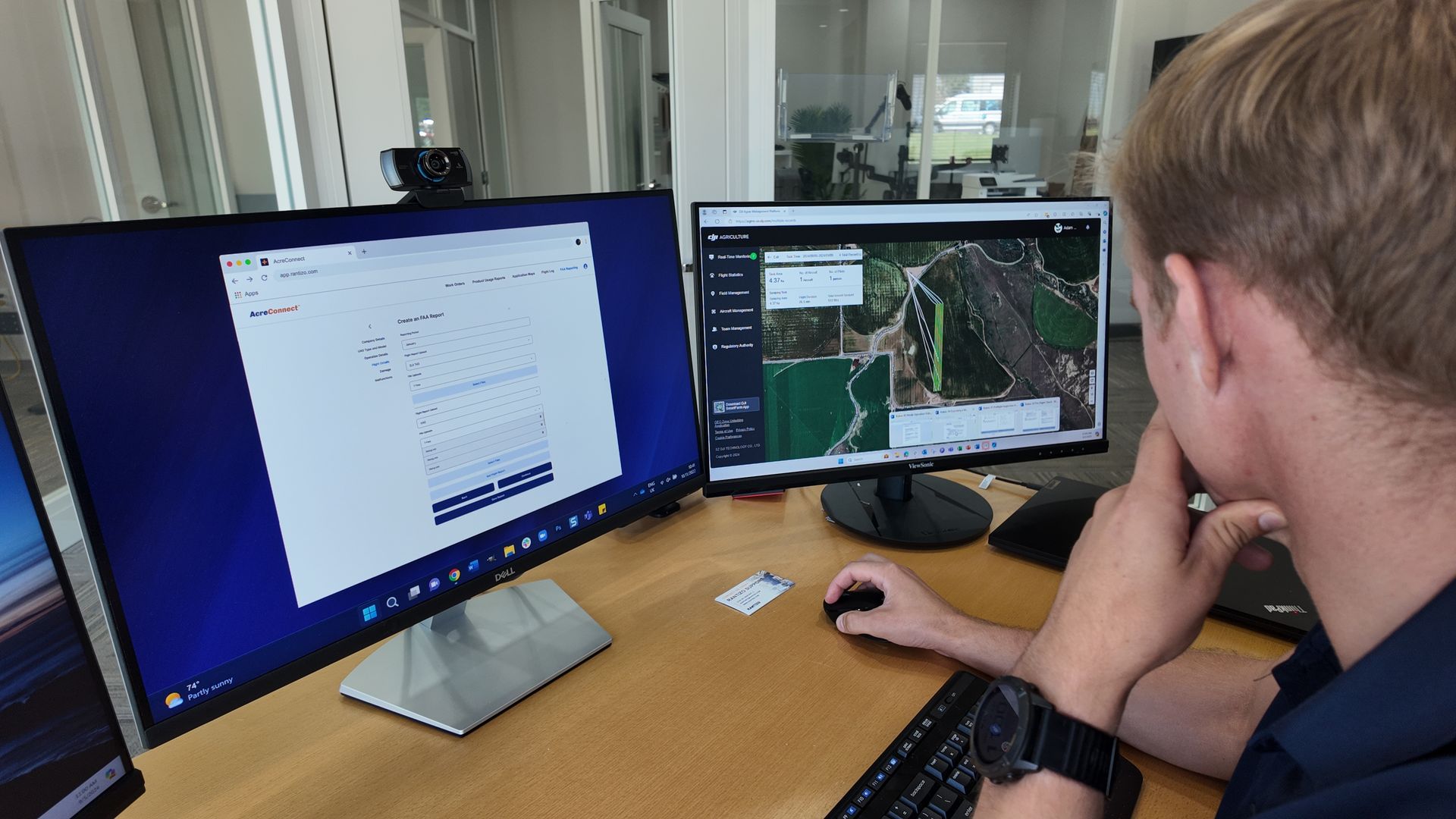

AcreConnect™ productivity software is now connected with the John Deere Operations Center™ through the John Deere API services. This connection allows Rantizo to significantly enhance the value of AcreConnect™ software by enabling spray drone operators to easily share application maps with customers on Operations Center.